GET STARTED TODAY

Whilst the previous ‘risk categories’ detailed above) were used as the framework for the mortgage lenders to decide on whether to approve or decline a mortgage application, it is fair to say that the structure was outdated and not fit for purpose. The so-called ‘7m rule’ focused more on what has been demonstrated to be an overstated risk of Japanese knotweed to buildings, rather than its potential impact on amenity (we now know that the roots seldom spread more than 3m laterally).

New Assessment Process

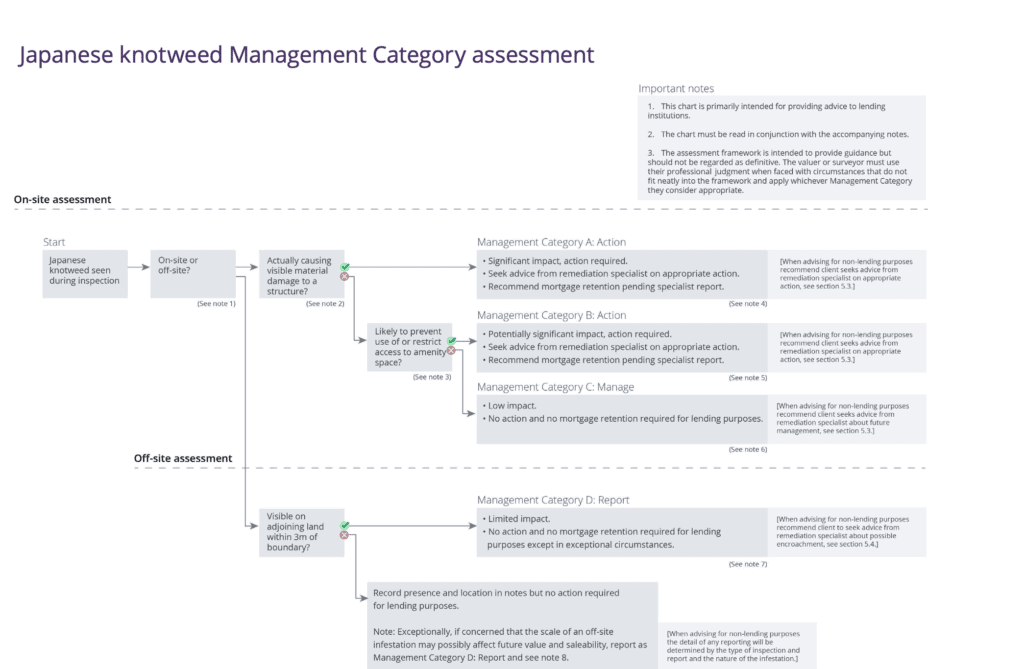

The new assessment process enables the valuer or surveyor to carry out a structured assessment, that leads to an objective categorisation. It is a more a definitive guide as to the full extent of an infestation and allows the ‘real impact’ of any given infestation, relative to its location and the specifics of the affected property to be established.

Although there are similarities to the assessment process, instead of the previous risk categories, the new guidance is focused on ‘Management Actions and will focus on matters such as loss of amenity space and actual damage to structures. The previous 7m rule of Japanese Knotweed being visible beyond a property boundary, has been replaced with 3m. The main objective of the Management Category assessment process is to provide consistency across the residential property market so that all stakeholders can understand the significance (or lack of) of Japanese Knotweed at or near any given property.

Before & After

The ‘new’ categories are detailed below:

Management Category A – Action required.

Management Category B – Potential significant impact. Action required.

Management Category C – Low Impact

Management Category D – Limited Impact.

Client note – We anticipate that it’s highly likely any property deemed to be management category A or B, will almost certainly trigger the requirement for a Japanese Knotweed Management Plan (JKMP), supplemented by a 5 or 10-year Insurance Backed Guarantee (IBG) (again, that’s not conclusive, it’s merely what we foresee will happen sooner or later). As we advance with time, we also predict that an infestation fitting the criteria of a management category C & D is far less likely to be an issue for the lender.